Medicare Unveils Hospice Payment Reform Plan

Get ready for a 2-tier reimbursement model.

Hospices with long-stay and nursing home patients may see significant pay drops next year, if a new proposal is adopted.

The Centers for Medicare & Medicaid Services issued the proposed rule for 2016 hospice payment April 30, and it contains a major revamp of how Medicare will pay hospices.

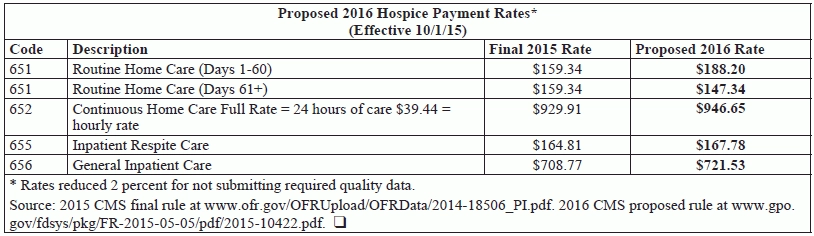

Old way: Currently, hospices receive the same payment amount ($159.34) for routine home care (RHC) days for the duration of a patient’s stay.

New way: CMS proposes to pay hospices a higher rate ($188.20) for the first 60 days of a patient’s episode, then a lower rate ($147.34) starting on day 61 until the end of care, it reveals in the rule published in the May 5 Federal Register.

Plus: In order to capture higher costs at end of life, CMS proposes adding a Service Intensity Add-on (SIA) payment when a registered nurse or social worker furnishes visits in the last seven days of care. Hospices could bill RN and SW visits at the CHC hourly rate for up to four hours a day, if the following conditions are met, CMS sets out in the rule:

That’s right: SNF and NF patients would not qualify for the SIA payments.

The SIA rate is calculated using the CHC hourly payment rate (proposed at $39.44 for 2016) and the amount of direct patient care hours provided by the RN or SW. The SIA “allows for additional payment without the 8 hour minimum requirement for continuous home care,” explains Judi Lund Person with the National Hospice & Palliative Care Organization. “In reality, hospices have not been paid extra for these services, so it is a recognition that patients in the last 7 days of life have more skilled needs that specific hospice staff can address.”

The methodology for CHC, inpatient respite care, and general inpatient (GIP) care would stay the same. Those rates would increase by the 1.3 percent payment update (before sequestration).

CMS expects the rate update to add $200 million to Medicare hospice spending in 2016. That includes a 1.8 percent inflation update, minus effects from wage index changes.

Detail: The payment methodology change is budget neutral, CMS notes in the rule. Thus, the funding for the SIA payments comes out of the RHC rates across the board.

Loophole closed: CMS anticipated that hospices could discharge and readmit, or transfer, patients to circumvent the lower payment rates that begin on day 60 of a stay. “In order to mitigate potential high rates of discharge and readmissions, we … propose that the count of days follow the patient,” the agency sets out in the rule. “For hospice patients who are discharged and readmitted to hospice within 60 days of that discharge, his or her prior hospice days will continue to follow the patient and count toward his or her patient days for the receiving hospice upon hospice election. The hospice days would continue to follow the patient solely to determine whether the receiving hospice may bill at the 1 through 60 or 61+ RHC rate.”

In other words: “We consider an ‘episode’ of care to be a hospice election period or series of election periods separated by no more than a 60 day gap,” CMS explains.

A hospice caller in CMS’s May 6 Open Door Forum for hospice providers asked whether that 60-day episode would restart if the hospice patient transfers from another provider.

If the patient receives care from another hospice then transfers to you without a 60-day gap, then “you’ll be getting the lesser amount” for 61 days or more, confirmed CMS’s Randy Throndset.

At least the Medicare claims system will be reconfigured to show hospices which days a patient is in, CMS’s Wendy Tucker said in response to a question from Jennifer Handel with Hospice of Michigan in the forum. However, that is assuming that the other hospice’s billing is up to date, experts point out.

Winners And Losers

The hospices that would suffer the most under the new methodology are those with long-stay and nursing home patients. “For hospice companies listed in the 95th percentile by CMS, which have over 50 percent alive discharges and are over the payment cap, there clearly will be negative consequences in the near term,” adds financial advisory firm Precipio Health Strategies in analysis of the proposed rule. “CMS is trying to weed out these companies because they question the type of care being delivered or if the patient even meets the criteria to receive hospice care.” Washington, D.C.-based Precipio expects to see “some of the fraud and abuse by the small minority of companies … significantly reduced or eliminated.”

CMS directly quoted publicly traded companies’ statements about longer stays and profitability in the rule. For instance, VistaCare (subsequently acquired by Odyssey HealthCare, then Gentiva) said “Our profitability is largely dependent on our ability to manage costs of providing services and to maintain a patient base with a sufficiently long length of stay to attain profitability,” the rule notes.

Winners will be those hospices already treating a higher proportion of short-stay patients, and those already furnishing RN and SW visits in the last days of care.

Margins: Under the proposal, CMS expects nonprofits’ reimbursement rates to increase 2.7 percent, while for-profits’ rates will go up 0.3 percent, notes the Visiting Nurse Associations of America.

Weigh in: Hospices have until June 29 to comment on the rule. They may submit comments at https://federalregister.gov/a/2015-10422 — click on the green “Submit A Formal Comment” link in the upper right hand corner. The final rule is expected out in late July or August.

Note: See the rule at www.gpo.gov/fdsys/pkg/FR-2015-05-05/pdf/2015-10422.pdf.