Get Ready For Major Payment Level Rebalancing

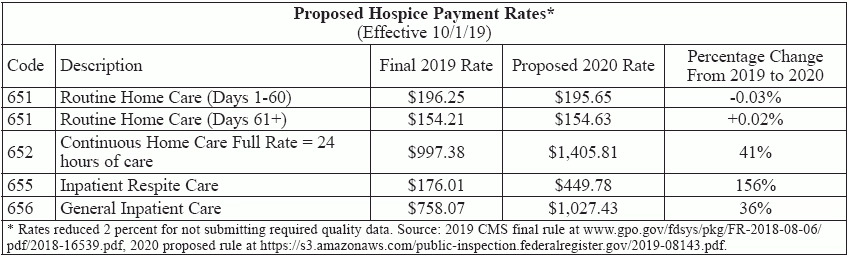

Tip: Look at your GIP contracts closely for a break. Hospices that furnish mostly Routine Home Care visits will see a drop in payment next year, if a new proposed rule is finalized. The Centers for Medicare & Medicaid Services has proposed reducing RHC payment rates and increasing the rates for the other three levels of hospice care — General Inpatient Care, Inpatient Respite Care, and Continuous Home Care. CMS includes the change in its fiscal year 2020 proposed rule for hospice payment, which would take effect Oct. 1. Specifically: CMS wants to reduce RHC rates by 2.71 percent, while increasing GIP, IRC, and CHC rates by large amounts (see chart, p. 43, for proposed payment levels). The RHC 2.71 percent cut is mitigated by the proposed payment update of nearly the same amount, 2.7 percent, for 2020. And each rate level is also influenced by items such as the Service Intensity Add-on budget neutrality factor, wage. index standardization factor, and for IRC, a 5 percent coinsurance adjustment. Remember: While the RHC “early” rate dips only slightly and “late” rate increases a smidge, they are down compared to where they would be without the rebalancing reduction, experts point out. And every hospice’s wage index will influence their payment rates, reminds Dave Macke, director of reimbursement services with VonLehman & Co. in Fort Wright, Kentucky. CMS also proposes increasing the annual aggregate cap to $29,993.99. That’s up from the current $29,205.44. CMS’s rebalancing proposal is far from a surprise, notes Theresa Forster with the National Association for Home Care & Hospice. The agency has been drawing attention to the disparity between hospice costs and payments for years, and in its latest report, the Medicare Payment Advisory Commission noted the differences and advised future rebalancing (see Eli’s Hospice Insider, Vol. 12, No. 5). The degree to which CMS wants to change the rates is also not a shock, since the adjustments are “generally consistent with previous data analysis by CMS,” Forster tells Eli. In the proposed rule, CMS notes that hospice cost report data indicate costs for CHC exceeded payments by 36.6 percent, for IRC by 160 percent, and for GIP by 31.2 percent. GIP, IRC Pay Raises To Go Right Back Out The Door With CMS and MedPAC beating the drum on the cost versus payment difference for years, the industry has been “fearful of rebalancing,” Macke notes. And that appears justified, according to the proposed rule. The rate changes are bad news for hospices, experts warn. “Generally, the rate modifications will negatively impact the financial results of most hospices,” explains consulting firm The Health Group in Morgantown, West Virginia. That’s because the overwhelming majority of hospice days are for RHC. “A review of claims over the last 10 years shows that RHC remains the highest utilized level of care, accounting for an average of 97.6 percent of total hospice days; GIP accounting for 1.7 percent of total hospice days; CHC accounting for 0.4 percent of total hospice days; and, IRC accounting for 0.3 percent of total hospice days,” CMS notes in the rule. And the increases for GIP and IRC will mostly be passed along to their facility partners for those care levels. “GIP care is almost always a pure pass-through to a hospital, which admits the patient under contract to the provider,” points out attorney Brian Daucher with Sheppard Mullin in Costa Mesa, California. “Hospices keep no money for this.” Hospices that have contracts passing through 100 percent of their GIP rate to the host hospital “will have the double whammy effect of not realizing the GIP increase” and taking the RHC hit, says Christopher Acevedo with Hospice Fundamentals in Delray Beach, Florida. “Those hospice organizations that have rental agreements that are not contractually bound to a percentage of the GIP rate will actualize the increase,” though, Acevedo offers. Hospices will receive a cut on RHC rates, while increases get passed along to other providers, Forster underscores. That negates the budget neutrality to an individual organization. Plus, “there is tremendous variance among hospices in how they fulfill their inpatient care obligations, and this translates to wide variance in costs for inpatient care,” Forster adds. Exception: Hospices operating their own freestanding inpatient units may benefit from the rebasing, The Health Group points out. But that’s an exceedingly small percentage of providers. There is one good thing. “The increased rates for continuous home care are much needed, as the costs of continuous home care have historically exceeded the reimbursement,” The Health Group allows. But many hospices may find access to CHC limited more by staffing restraints than by payment levels, Forster notes. Impact: For-profit hospices will be hit hardest by the changes, CMS indicates in its impact analysis. For example, freestanding nonprofits will see a 4.2 percent pay increase in 2020 under the proposal, while freestanding for-profits would see only a 1.8 percent bump. “CMS’s favorite targets, for-profit hospices, will pay for these shifts,” Daucher tells Eli. The rate rebalancing will also cost hospices on another front not addressed in the rule — increased audits. “Where higher levels of care are provided [under] GIP/CHC/IRC, such claims are subject to more audit adjustment,” Daucher says. Auditors come in and say “not necessary” and reduce the rate to the RHC level, he says. The jury is still out on whether these changes will increase access to non-RHC levels of care, and thus their utilization. “We do hope hospices that otherwise had difficulty will be able to secure inpatient contracts and that the added payment for CHC will help,” Forster says. CMS has been hearing about facility access problems for years, it notes in the rule. But much of the demand for those higher levels of care is driven simply by patients’ medical needs, Macke points out. That doesn’t leave much room for increased utilization. And “hospices must be able to justify use of these levels of care as reasonable and necessary based on the individual patient’s need,” Forster stresses. Apart from the implications of the individual changes, the hospice payment system has just gotten too complex, Daucher contends. “Tinkering with reimbursement, a process begun with the two-tier RHC three years ago and continuing now with rebasing GIP/IRC/CHC, is not a good idea overall,” he argues. “Hospice has enjoyed a stable and simple payment platform for 35 years; the more CMS feels free to tinker, the more hospices will be exposed to the whims of CMS managers over time. See home health and other benefits, that have suffered wild swings in reimbursement.” That goes for more RHC rebasing, Daucher predicts. CMS takes pains to point out that it is rebasing the three higher care levels, not RHC, the National Hospice & Palliative Care Organization notes in its member summary of the rule. “While we are rebasing the per diem payment rates for CHC, GIP, and IRC to more accurately align the payment with costs, the reduction to the RHC payment rates is not considered rebasing as the 2.71 percent reduction does not bring the RHC payment in alignment with the costs of providing this level of care. The purpose of the 2.71 percent reduction to the RHC payment rates is to ensure that the revisions to the payment rates for CHC, GIP and IRC are made in a budget-neutral manner, in accordance with the law,” the rule says. Note: See the 49-page rule at www.govinfo.gov/content/pkg/FR-2019-04-25/pdf/2019-08143.pdf. Comments are due by June 18.