Routine Home Care Rates Cut 2.72% In Rebalancing

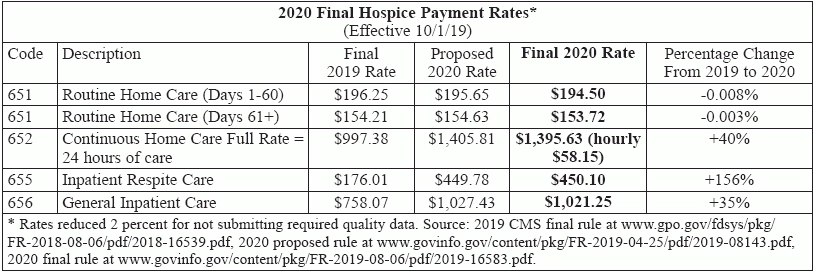

Final rule follows through on proposed increases to GIP, CHC, and IRC. Providers that mostly furnish Routine Home Care or GIP in other facilities are getting the bad end of the deal in Medicare’s payment rebalancing between care levels. Why? As it proposed back in April, the Centers for Medicare & Medicaid Services is moving forward with rebalancing payment rates for the three higher levels of hospice care — General Inpatient, Continuous Home Care, and Inpatient Respite Care, according to the 2020 final payment rule for hospice published in the Aug. 6 Federal Register. Medicare has seriously underpaid the advanced levels of hospice care, suggests new cost report data. The final rule rebases GIP, CHC, and IRC “per diem payment rates in a budget neutral manner to more accurately align payments with the costs of providing care,” the rule says. IRC will see the biggest increase at 156 percent over 2019 rates. CHC follows at 40 percent and GIP at 35 percent (see chart, p. 67). The change takes effect Oct. 1. The FY 2020 cap will be $29,964.78. That’s up from the current $29,205.44, but down from the proposed $29,993.99. “Using information collected from the revised hospice cost report, for the first time, we are able to estimate hospices’ average costs per day by level of care,” CMS says. To make the increases for those levels budget-neutral as required by law, CMS turns to the most common level of care provided — Routine Home Care. Without rebalancing, RHC rates would have increased 2.6 percent thanks to the market basket inflation update. However, to pay for the GIP, CHC, and IRC increases, CMS decreases RHC rates by 2.72 percent (that’s slightly more than the proposed 2.71 percent, due to additional available cost data). When you figure in factors such as the Service Intensity Add-on budget neutrality factor and wage index standardization factor, you end up with rates that are just slightly lower than this year’s (see chart, page 67). “The payment increase helps mask the rebasing this year, which makes it temporarily more palatable,” attorney Brian Daucher with Sheppard Mullin in Costa Mesa, California, tells Eli. The rebalancing “will create financial winners and losers — mostly losers,” says consulting firm The Health Group in Morgantown, West Virginia. “Hospices with minimal inpatient care and inpatient respite care will not recover the revenue loss resulting from the reduction in routine home care rates,” the firm says in its electronic newsletter. “Those hospices that contract with hospitals for general inpatient care will pass most, if not all, of the increase on to the hospital as a result of the contract with those facilities.” In many cases, “the higher rates will be passed through to contracted facilities and hospices will have less revenue overall with which to operate,” says Theresa Forster with the National Association for Home Care & Hospice. On the other hand: Providers that will benefit from rebalancing are those that run their own inpatient facilities, notes Dave Macke, director of reimbursement services with VonLehman & Co. in Ft. Wright, Kentucky. “For hospices with leased or owned hospice inpatient facilities, the increase in GIP will be very helpful for operating in the black,” expects Judi Lund Person with the National Hospice & Palliative Care Organization. But relatively few hospices own and/or operate their own inpatient facilities, experts note. “We remain concerned about unintended consequences that may result from the redistributional impact of these changes,” Forster tells Eli. “Hospice financial margins vary widely, and we believe small and/or more rural hospices may begin to experience some serious financial difficulties.” Commenters on the proposed rule hit on these same points, and more, in their letters. They lodged many complaints and concerns about the significant reduction to RHC rates, including that it would threaten access to hospice care. It Could Be Worse, CMS Maintains But CMS seems to turn a deaf ear to those criticisms, characterizing the RHC reductions as minor. The “reduction equates to approximately 37 cents on RHC days 1 through 60 and 29 cents on days 61 plus,” compared to 2019 rates, the rule contends. “Given that [the Medicare Payment Advisory Commission] in their recent March 2019 Report recommended a 2 percent reduction to the hospice base payment rates and projects Medicare hospice margins to be 10.1 percent for 2019, we feel the reduction to the RHC payment rate would not create financial hardships for hospices.” CMS dismisses access concerns as well. “Aligning the payment with the cost of providing care should have a positive effect on access to needed levels of care,” the rule argues. Because cost report data shows that the payment level for RHC exceed costs by 18.1 percent for days 1-60 and 19.3 percent for days 61+, hospices should have no trouble absorbing the 2.72 percent decrease to RHC rates, CMS seems to believe. CMS waves aside another concern about unneeded advanced levels of care. “Many hospices, along with MedPAC, noted concerns about creating incentives for hospices to improperly expand the use of inpatient levels of care as a result of rebasing,” the agency acknowledges in the rule. That goes particularly for GIP. “We expect to see a bit more utilization of these levels of care,” notes Lund Person. Some utilization rise is expected — and desired, CMS says. “The rebased rates will help appropriately increase access to care,” the rule notes. “There may be an increase in utilization of these higher intensity levels of care, but we believe that this may be appropriate to meet patient care needs.” The “criteria for receiving these higher levels of care … may potentially buffer any inappropriate increases in utilization,” CMS expects. Bottom line: “We continue to expect hospices to provide care in accordance with the individualized plan of care as required by the hospice CoPs,” CMS stresses. “We do not expect that hospices would move patients into higher intensity levels of care solely to receive higher payments.” But: “We are aware of the perverse incentives that could occur with increases in payment rates,” the rule allows. “As part of our routine monitoring of hospice utilization, we will continue to closely analyze any changes in the patterns of care ... to determine if any additional actions are warranted.” Take the agency at its word, Forster urges. “We expect CMS to be monitoring changes closely to ensure that these changes are in response to need rather than to changing financial incentives,” she says. “We caution hospices to pay close attention to eligibility, especially for GIP, as the scrutiny for that level of care continues,” Lund Person urges. (See more about SMRC GIP review, p. 68.) CMS also discounts commenters’ assertion that the increase to inpatient care levels will result in payment increases for the facilities they contract with, while hospices take the pay cut in RHC. “Putting more money into GIP from routine is simply a transfer of revenue from hospice to hospitals, since GIP payments are just passed through to hospitals,” Daucher maintains. CMS puts the blame for a pass-through on providers. “Hospices would have to negotiate appropriate rates with the contracted providers to ensure that the hospice has sufficient resources to provide the necessary care,” the rule says. In addition to the RHC rate cut, hospices will face another reimbursement-threatening consequence of rebalancing: increased audits and resulting takebacks. “Enhanced care levels come with materially increased audit risk,” Daucher maintains on Sheppard Mullin’s Hospice Law Blog. “Auditors regularly scrutinize enhanced care days and conclude that only routine care days were justified, demanding incremental refunds. Although hospices will have paid hospitals and other caregivers to provide enhanced care (and taken a cap hit for such revenue),” auditors may demand refunds, says. “It’s cruel to expose providers to this risk, especially where ... they don’t keep, and can’t expect to recover, the money they hand over to hospitals,” Daucher says. “Increased reimbursement rates increase the extent of this risk (and the prize for auditors).” Note: The final rule is at www.govinfo.gov/content/pkg/FR-2019-08-06/pdf/2019-16583.pdf.