Get the Four ABCs of ABNs

Learn how to use the ‘courtesy’ modifier.

You may often face this hurdle: what to do when a clinician orders a test that Medicare may not cover. If you think the answer is, “get a signed Advance Beneficiary Notice (ABN),” you’re only partially right.

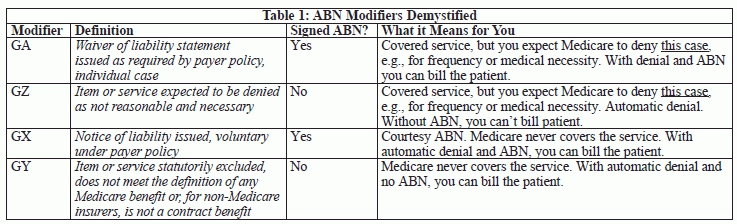

When to use an ABN and how to let your payer know that you have one can be a source of much confusion. Get on the right payment track with the following four myths and reality checks. Refer to Table 1 on page 292 to see the ABN modifier definitions.

Myth 1: You Must Get an ABN for Non-Covered Services

You’re not required to get an ABN if Medicare excludes the service by statute. For instance, by rule, Medicare does not cover most screening tests that a clinician orders in the absence of signs or symptoms of disease.

If Medicare never covers a procedure, the agency always considers the patient to be responsible for the payment. But does the patient know that?

Courtesy: Providing an ABN in these cases is voluntary, and most providers consider it a courtesy to the patient so that she doesn’t get surprised when the bill comes.

Do this: “Use GY or GX for excluded or non-covered services,” says Pamela Biffle, CPC, CPC-P, CPC-I, CPCO, owner of PB Healthcare Consulting and Education Inc. in Austin, Texas.

As you can see from Table 1, GX (Notice of liability issued, voluntary under payer policy) means that you voluntarily obtained a signed ABN, and GY means that you did not.

Myth 2: You Must Use ABN Modifiers

While it’s true that ABN modifiers often smooth claims processing and offer fraud-protection for services you expect Medicare to deny, you might want to avoid them in some circumstances.

For instance: You perform a Pap smear for a high risk patient, and you think that the repeat test is too soon based Medicare’s frequency guidelines, but you’re not positive of the last test date. Neither the ordering physician nor the lab obtained a signed ABN.

Exceeding frequency limits with no ABN normally warrants appending modifier GZ (Item or service expected to be denied as not reasonable and necessary) to the lab code, such as 88175 (Cytopathology, cervical or vaginal [any reporting system], collected in preservative fluid, automated thin layer preparation; with screening by automated system and manual rescreening or review, under physician supervision).

But Medicare states that modifier GZ results in an automatic claim denial. That means the payer won’t even review the claim to see if the test actually meets the frequency requirements, or other medical necessity requirements for that matter.

“You’re not required to append modifier GZ if you’re not certain that Medicare should deny the claim,” says Melanie Witt, RN, CPC, COBGC, MA, an independent coding consultant in Guadalupita, N.M.

Do this: Bill the claim without a modifier, and allow Medicare to either pay for the service or send a denial.

Caution: Be sure to monitor the account and make sure you write off the charge if Medicare denies the claim. You can’t bill the patient, in this case, because you don’t have a signed ABN.

Better: If you’re even considering using modifier GZ, that means you didn’t get an ABN when you should have. Set up procedures to ensure that you capture this document, when appropriate.

Myth 3: Using ABN Modifier Means You Can Always Bill Patient

Don’t confuse the value of acquiring a signed ABN with the value of using an ABN modifier. While it’s true that having a signed ABN on file means you can bill the patient if Medicare denies the claim, it is not true that billing with an ABN modifier gives you the same opportunity.

Remember: Two of the four ABN modifiers indicate that you do not have a signed ABN on file. And one of those modifiers — GZ — means that you should have acquired the document. If you use modifier GZ, you should not bill the patient or the secondary insurer.

Myth 4: ABNs Can Overcome CCI and MUE Denials

A Medicare claim denial due to a Correct Coding Initiative (CCI) edit or a Medically Unlikely Edit (MUE) seems to be either a non-covered service or non- medically reasonable or necessary service. And as you can see from Table 1, you can bill the patient for a non-covered service with or without an ABN (modifiers GX or GY), and you can bill the patient for a service that’s not medically reasonable or necessary if you have an ABN (modifier GA).

Does that mean you can bill the patient for claims denied due to a CCI or MUE edit?

No. The CCI Policy Manual has this to say:

“CPT® codes representing services denied based on NCCI edits may not be billed to Medicare beneficiaries. Since these denials are based on incorrect coding rather than medical necessity, the provider cannot utilize an [ABN] form to seek payment from a Medicare beneficiary.”

Bottom line: Denials due to breach of CCI edits or MUEs are the provider’s responsibility, not the patient’s responsibility.