Will Your Medicare Payments Go Up for CY 2018? Find Out Here

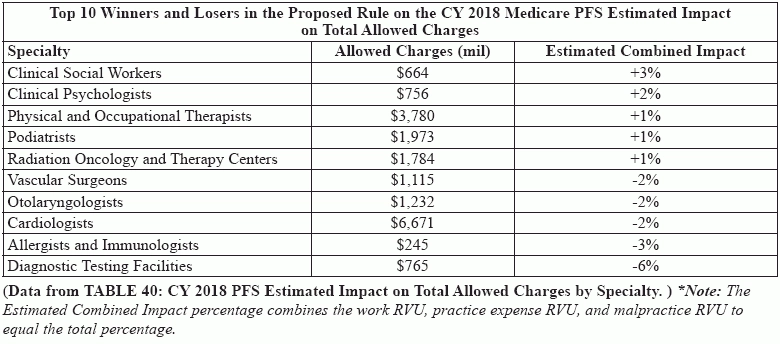

Reporting burdens may be eased, but don't expect your pay to go up. Providers may see MACRA's influence on their Part B payments next year as CMS revalues codes and services, according to the estimated impact section of the "Proposed Policy, Payment, and Quality Provisions Changes to the Medicare Physician Fee Schedule for Calendar Year 2018 (MPFS)," published in the Federal Register in July. Background: In its 2018 proposed fee and policy changes, CMS suggested a possible payment increase. "The overall update to payments under the PFS [Physician Fee Schedule] based on the proposed CY 2018 rates would be +0.31 percent," the CMS fact sheet on the 2018 proposals for the MPFS notes. "This update reflects the +0.50 percent update established under the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015." But a closer look at the changes suggests that not everyone will be celebrating in 2018. "The +0.31 percent increase suggests that CMS on an overall basis will see an increase in reimbursement to physician by 0.31 percent," says Vinod Gidwani, founder and president of Currence Inc. in Skokie, Illinois. "However, this can be very misleading. Every physician should consider doing some number crunching for their practice based on the 10 to 15 most common codes billed by the practice to Medicare." Federal dialogue: This slight boost is actually a cut as the fact sheet suggests overall payments might be "reduced by 0.19 percent, due to the misvalued code target recapture amount, required under the Achieving a Better Life Experience (ABLE) Act of 2014." If you are confused by the ups and downs, Gidwani suggests looking at each code individually to see the real impact. "Consider the weighting of each code billed. Next, using the new 2018 conversion factor of $35.99, determine the overall estimated impact the new fee schedule will have on your practice," he advises. "I understand the impact on some specialties could be as high as -6.0 percent." Will You Be Ahead of the Pack? Clinical social workers lead the pack of specialists who will prosper in 2018 if the proposed fee schedule is finalized, with an estimated combined increase of 3 percent, while diagnostic testing facilities look to see the biggest declines at minus 6 percent. The estimated combined impact percentages are calculated from the combination of physician work relative value units (RVUs), practice expense RVUs, and malpractice expense RVUs. Here's a look at the specialties most impacted by the proposals and their estimated increases and decreases under the 2018 proposed Medicare Physician Fee Schedule (MPFS): Consider This Insight on Relative Value Units The MPFS establishes different values for codes depending on the setting/site (facility or non-facility) in which the provider performs the service or procedure. For some services, the total RVUs for a given procedure are the same in a facility or a non-facility setting. In some cases, however, the two totals may differ. Nuts and bolts: The facility and non-facility total RVUs are the sum of three component RVUs: physician work RVUs (to cover the cost of the provider's "work"), practice expense RVUs (to cover the cost of supplies, equipment, etc.), and malpractice expense RVUs (to cover the cost of professional liability expenses). Physician work RVUs and malpractice expense RVUs are the same, regardless of the setting (facility or non-facility). Practice expense RVUs may vary by site of service, however (which accounts for the difference in facility and non-facility RVU totals for a given code). Medicare fees also vary geographically. Thus, each component RVU is multiplied by its own geographic practice cost index for the payment locality in which the service is rendered before the components are summed and multiplied by the dollar conversion factor that translates RVUs into fees. Non-facility calculations: Add together the physician work RVUs, the non-facility practice expense RVUs, and the malpractice RVUs for the total non-facility RVUs for a given code. To then figure out the national, geographically unadjusted Medicare fee for a code, multiply the transitioned non-facility RVU total by the proposed 2018 conversion factor ($35.99). Note that private payers and other public payers may use different conversion factors for setting their fees, even if they use the same RVUs as Medicare. Example: To calculate the geographically unadjusted Medicare fee for E/M visit code 99213 (Office or other outpatient visit for the evaluation and management of an established patient ...), multiply the transitioned non-facility total (2.06) by $35.99. You can therefore figure out that the 2018 unadjusted fee for 99213 is $74.14. You can simply look up national or local Medicare reimbursement rates for specific procedures on the Medicare website at www.cms.hhs.gov/PFSlookup, or on https://www.aapc.com/codes/. Many individual Medicare carriers also have similar web tools. Status quo: The vast majority of providers are likely to see very little impact on their allowable charges for CY 2018. But that doesn't mean that you won't feel the heat from certain code and service revaluations that go through under the final rule in the fall - so, don't get comfortable just yet. For a closer look at the detailed data and outlook by specialty, visit https://s3.amazonaws.com/public-inspection.federalregister.gov/2017-14639.pdf.