Know How the 2018 PFS Will Impact Your Practice's Bottom Line

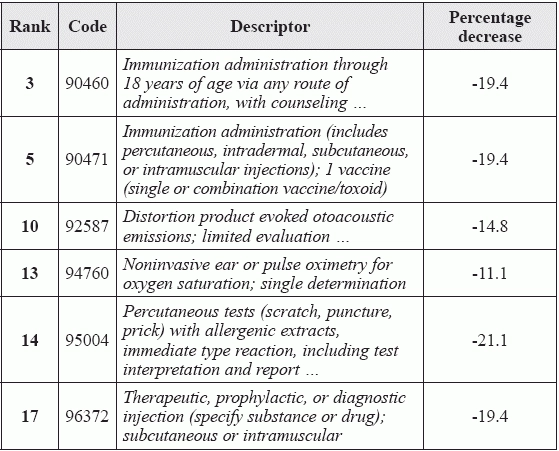

Your most-used codes and location could spell lower revenues. In November, the Centers for Medicare and Medicaid Services (CMS) released its annual revision of the Medicare physician fee schedule (PFS). This calculation of payments for services that physicians will perform next year will, for good or ill, impact your practice's bottom line in 2018. So, what's going to be in your practice's wallet this year? Read on and find out. Let's get Technical First, in order to understand how your practice's revenues could change, you need to understand how CMS calculates payments for each service covered under the PFS. This is important for peds practices, according to Donelle Holle, RN, President of Peds Coding Inc., and a healthcare, coding, and reimbursement consultant in Fort Wayne, Indiana, because "even though pediatrics doesn't pay much attention to Medicare guidelines, it is a good idea to have an understanding of how they work, as they do influence many other insurance carriers." Payments are based on a complex formula called the resource-based relative value scale (RBRVS), which uses relative value units (RVUs) for services that are based on the work, practice expense (PE), and malpractice insurance (MP) involved. According to the American Association of Pediatrics (AAP), "the physician work component represents approximately 50.9 percent of the total RVUs for each service," while PE "represents approximately 44.8 percent" and MP "approximately 4.3 percent." All these elements are then, in CMS's words, "adjusted by geographic practice cost indices (GPCI) to reflect the variations in the costs of furnishing the services." Then everything is multiplied by a conversion factor (CF) to produce a dollar value using the following formula: Payment = [(RVU work × GPCI work) Plugging In the Numbers: What Goes Up ... For 2018, CMS increased the conversion factor from $35.89 to $35.99. In other words, everything you do will get multiplied by approximately 10 cents for an overall increase to your bottom line next year. Sounds good, right? Not so fast. First, you need to look at the changes in RVUs for 2018. Every year, Chip Hart, director of PCC's Pediatric Solutions Consulting Group in Vermont and author of the blog "Confessions of a Pediatric Practice Consultant," performs an exhaustive analysis of the PFS. One part of that analysis involves examining the RVU changes for 37 of the most frequently performed pediatric services to determine their impact on peds practices across the country. The picture Hart reveals is not particularly rosy. Just two of those codes - 96110 (Developmental screening (eg, developmental milestone survey, speech and language delay screen), with scoring and documentation, per standardized instrument) and 96127 (Brief emotional/behavioral assessment (eg, depression inventory, attention-deficit/hyperactivity disorder [ADHD] scale), with scoring and documentation, per standardized instrument) - show substantial increases (7.4 and 12.5 percent, respectively). ... Must Come Down But increases are the exception. Far too many common pediatric services show substantial decreases. Consider the following changes to six codes that are among the top 20 of all pediatric services: And many of the most commonly used evaluation and management services (E/M), especially 99211-99215 (Office or other outpatient visit for the evaluation and management of an established patient ...), show negligible increases - outside of the 7 percent increase for 99211, the established patient E/M service increases range from 0-0.8 percent. Hart's final analysis? "If pediatricians do in 2018 what they did in 2017, their RVUs will drop 2.2 percent." Location, Location, Location Then, there is the most overlooked factor in this equation: the GCPI. According to Hart, this component is why "some localities have had massive swings in RVU value over the last decade." Hart points out that this year's GCPI shows some big swings in revenue across the US, from a 4.6 percent drop in Indiana to a 16.9 percent increase in Puerto Rico, with most areas seeing a roughly 1 percent drop over last year's income. According to Hart, this means that "if you're in Orange County, California, your RVUs will drop 3 percent in 2018 whether you like it or not. Idaho? -4.3 percent. Practices in Massachusetts get a 5 percent boost! Practice in southern NJ? That -1.8 percent comes right out of your owner income." But, as Hart cautions, "you really need to look at these swings over time." And such swings and other changes to the PFS are significant and worth your study, Holle concludes, as "they will help your practice to estimate payments in the future from other carriers." To view Hart's analysis of GCPI and RVUs and see how they will affect your practice in 2018, visit Hart's blog at http://chipsblog.pcc.com/. And to locate the 2018 RVUs for a specific CPT code:

+ (RVU PE × GPCI PE) + (RVU MP × GPCI MP)]

× conversion factor (CF).