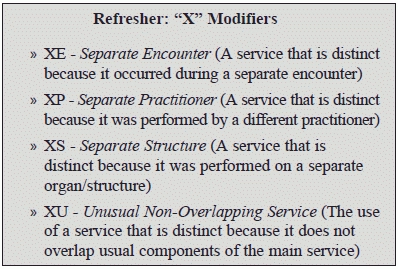

Take a Giant Leap Forward in Payments with the New "X" Modifiers

Successfully implement the X {EPSU} Modifiers with this useful tip.

Started working with the new off shoots to modifier -59 (Distinct procedural service) yet? Whether you’ve tried the new options yet or are still deciding how to best report them, here are some instances that DCs should take note of.

Background: Modifier -59 is a widely used modifier to indicate that a code represents a service that is separate and distinct from the concurrently performed service on the patient, saving it from the usual default bundling. Unfortunately, the payers have had a tough time with modifier -59 claims, thanks to the unscrupulous and incorrect use of this modifier.

The tussle continues: DCs use modifier -59 most commonly when performing 97140 (Manual therapy techniques [eg, mobilization/ manipulation, manual lymphatic drainage, manual traction], 1 or more regions, each 15 minutes) and Chiropractic Manipulative Therapy (CMT) (code range 98940-98942) in the same visit. As the rule goes, in such a case, you must not have performed 97140 on the same body part where you have performed chiropractic manipulation if you expect to be reimbursed for both services. If the DC has provided both the treatment modalities to the same region within a single visit; manual therapy, regardless of the type, will be bundled with chiropractic manipulation or CMT services.

Why do you need to know this “elementary” concept? Because both Medicare and private payers alike have ruefully admitted to the above mistake being made in a majority of instances, where some DCs have unthinkingly billed both the services together with modifier -59 in the past. To the payer’s utmost dismay, manual therapy was performed in the same region as CMT. The case was made worse with limping documentation unable to justify the claim.

“For many years, DCs were not monitored regarding their documentation and billing. Recent audits by the OIG, CMS, and other insurance companies have caught many mistakes-and encouraged DCs to rethink how they document,” describes Elizabeth Earhart, CPC, with Godshall Chiropractic in Millersville, PA. She also adds that “Increased awareness of the value of chiropractic care and participation with insurances has brought those eyes.”

The snowball effect: The insurers started denying claims the moment they saw 97140 with CMT, regardless of the modifier use. They would relent only when the provider would supply requisite documentation proving medical necessity and establishing the fact that the treatments were provided on separate regions.

Getting Started With the New Modifiers

Your first step toward avoiding this situation is to align claims with the requisite guidelines. Here’s an example on how to report CMT codes in conjunction with 97140:

Example: Suppose you receive a 50-year-old banker with neck pain (723.1, Cervicalgia) and low back pain (724.2, Lumbago) for the past year. Two weeks ago, the patient was in an uneventful car accident. You suspect he may probably have sustained neck injury. There are, however, no signs or symptoms of an acute injury presently. The DC decides to play it safe, giving only mild manual traction to the neck to break the muscle spasm, and decides to perform chiropractic manipulative therapy to the lumbar region. You shall therefore report 97140 for the cervical region and 98940 (Chiropractic manipulative treatment [CMT]; spinal, 1-2 regions) for the lumbar region. Starting January 5, 2015, you should also append modifier XS (Separate structure) to imply that you provided a distinct procedural service to a separate body part altogether, though on the same visit. In the given scenario, modifier XS is probably one of the most useful tool that DCs will find to their respite. “XS is the best modifier to use in this instance as long as there is documentation to support it,” affirms Earhart.

Final takeaway: “If you treat, document it. If you document it, bill it. Make sure you follow the guidelines. Educate yourself on the codes,” advises Earhart. She also reveals that, “I have talked with other offices to find out that many do not have up to date code books or know the guidelines because for years there weren’t any.”

Remember: Though CMS continues to recognize the -59 modifier, make sure you do not use it if you can report a more descriptive and apt modifier that is available. Otherwise, the claims may be denied, request for information, and audits may ensue. Therefore, as Medicare suggests, it is in our best interest to use the more detailed X {E,P,S or U} modifiers when appropriate.