Refresh Your Knowledge of 2023 Coding Updates With This Quick Q&A

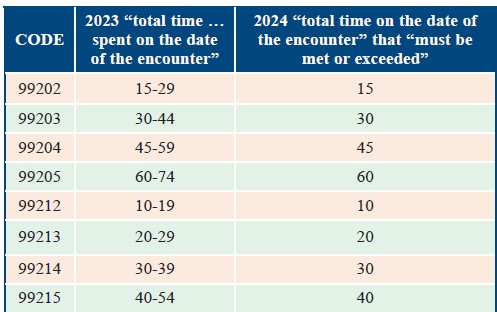

Familiarizing yourself with recent coding updates will be the key to a successful new year. Throughout 2023, Podiatry Coding Alert has worked hard to educate you on the new codes, especially the significant shift in time coding for office/outpatient evaluation and management (E/M) visits. But how well do you remember those changes? Read on to refresh your memory and avoid claim denials in 2024. Make Note of These CPT® Updates Question: Were there any podiatry-related CPT® codes introduced this year that we should be aware of? Answer: Two new CPT® codes that have been introduced can be useful regarding the extraction of sutures or staples after podiatric surgery: CPT® code 15853 (Removal of sutures or staples not requiring anesthesia (List separately in addition to E/M code)) and 15854 (Removal of sutures and staples not requiring anesthesia). The key difference between these two codes being 15854 would be used when removing both sutures and staples, not just one or the other; and 15854 is a standalone code, whereas 15853 would need to be linked to a separate E/M code. Coding example: Patient is three days postoperative for left foot, second digit. During the examination, it is determined that it is appropriate to remove sutures related to procedure. In addition to the E/M service provided during this visit you will report code 15853 to capture the work associated with the suture removal. As per the new coding guidelines presented in 2023, this code is reported separately in addition to the E/M code. There is no global period attached to this code or the additional code 15854. Quick tip: The following are examples of common podiatric procedures that may involve the use of sutures or staples and have 0-day global periods: See How New Socioeconomic Codes Come Into Play Question: Were there any important ICD-10 coding updates for 2023 that might affect podiatry? Answer: The most important change involves an expansion of the Y07.- (Perpetrator of assault, maltreatment and neglect) code group, and new codes in the Persons with potential health hazards related to socioeconomic and psychosocial circumstances (Z55-Z65) section. Three of the new codes in particular could easily come into play in the podiatry setting: How will this relate to podiatry? “You must realize that, after surgery, it will be difficult for the patient to change a dressing every day if they are living in their car, for example. An alternative treatment plan may be necessary in situations like this,” said Betty A. Hovey, BSHAM, CCS-P, CDIP, CPC, COC, CPMA, CPCD, CPB, CPC-I, AAPC Approved instructor, during her presentation, “Understanding the MDM Table,” at the La Crosse, Wisconsin, AAPC chapter meeting in August. Take note: The inclusion terms associated with the Z55.6 code include challenges in comprehending health-related information, issues with understanding instructions related to medication, and difficulties in filling out medical forms. Watch For These E/M Changes Question: What changes were made in 2023 related to E/M time coding and the prolonged service codes? Answer: CPT® has opted to eliminate the time ranges from both new and established office/outpatient E/M codes. Instead, they are substituting them with a single total time value, which corresponds to the lowest number of minutes currently in the range for each code. This time “must be met or exceeded” according to the new wording that now appears in each of the codes’ descriptors. In table form, the changes look like this: Essentially, “this doesn’t really change how the codes are used, but listing the minimum time instead of a range for each code is probably going to be easier to follow,” says Kelly Loya, CPC, CHC, CPhT, CRMA, CHIAP, associate partner at Pinnacle Enterprise Risk Consulting Services. What will happen to G2212? One possible result of this change may be the resolution to the dispute between CPT® and Medicare over the prolonged service threshold times. Basically stated, Medicare created their own code, G2212 (Prolonged office or other outpatient evaluation and management service(s) beyond the maximum required time of the primary procedure …), as AMA/ CPT® viewed prolonged services as beginning at the minimum time for 99205/99215 and the Centers for Medicare & Medicaid Services (CMS) beyond the maximum. Now that the time ranges for 99205/99215 have been replaced by a threshold at the minimum end of the range, it is possible that Medicare may follow CPT® rules and adopt +99417 (Prolonged outpatient evaluation and management service(s) time … each 15 minutes of total time …) for prolonged services instead. Remember: In 2023, CPT® removed the words “beyond the minimum required time” from the descriptor for +99417, which now reads (Prolonged outpatient evaluation and management service(s) time with or without direct patient contact beyond the required time of the primary service when the primary service level has been selected using total time, each 15 minutes of total time (List separately in addition to the code of the outpatient Evaluation and Management service)). “It is important to note that for CMS payers that follow the CMS threshold, you will be required to meet the threshold of 15 minutes beyond the end of the highest-level time. For instance, if billing a 99205 [Office or other outpatient visit for the evaluation and management of a new patient, which requires a medically appropriate history and/or examination and high level of medical decision making. When using time for code selection, 60-74 minutes of total time is spent on the date of the encounter] with a required range of 60-74 minutes, CMS will require you to meet at least 89 minutes to use the prolonged services code. So even though CPT® language does indicate ‘beyond the required time’, you will need to document the correct time threshold for CMS claims,” says Jennifer McNamara, CPC, CCS, CRC, CPMA, CDEO, COSC, CGSC, COPC, director of healthcare training and practice support at Healthcare Inspired LLC. Bella Vista, Arkansas. For 2023, CPT® also deleted prolonged service codes +99354 and +99355. In their place, you’ll now use +99417, as CPT® has increased its scope. CPT® has also made one other slight change. This change applies to the nursing facility care codes 99306 (Initial nursing facility care, per day, for the evaluation and management of a patient …) and 99307 (Subsequent nursing facility care …), raising their time thresholds by five minutes to 50 and 20 minutes, respectively. “It will be important for podiatry providers to know these new, higher thresholds if they are seeing patients in a nursing facility,” Loya notes. Keep Your Forms Updated Question: Was there an updated ABN form that became available this year? Answer: Yes. The correct advance beneficiary notice (ABN) form for use on and after April 4, 2023, is CMS-R-131 (Exp. 01/31/2026). CMS now offers additional guidelines for patients who are covered by both Medicare and Medicaid, who are known as dual-eligible beneficiaries. These patients cannot be charged for Medicare cost-sharing when they receive services under Medicare Part A or Part B. ABN form defined: An ABN form is a written notification indicating that Medicare may refuse to cover or reimburse for services or items recommended by your doctor, healthcare provider, or supplier. This form is used to inform the patient in advance about their potential financial responsibility for the services or items in question. By signing the ABN form, the patient acknowledges their understanding that they may be responsible for payment if Medicare denies coverage. The ABN also ensures transparency and allows patients to make informed decisions regarding their healthcare and associated costs before treatment. Don’t forget that you must provide the patient with a copy of the signed ABN, and you should keep the original ABN on file. To access the newest ABN form and the latest instructions, go to www.cms.gov/Medicare/Medicare-General-Information/BNI/ABN.