What Do You Think?

Question 1: One of our resident’s takes Neurontin twice daily for neuropathic pain. Can I code this pain medication in Section J even if the drug is not an analgesic?

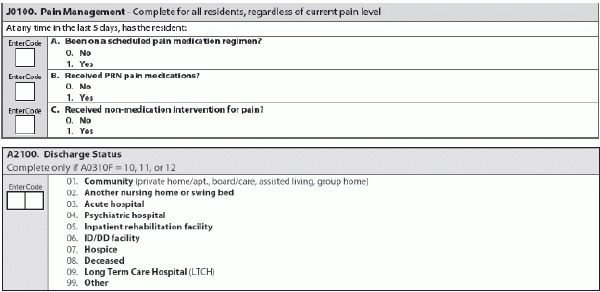

Answer 1: Yes, you can code a pain medication regimen to manage neuropathic pain, according to the California Department of Public Health’s (CADPH) Center for Health Care Quality Licensing & Certification. Code 1 — Yes in Item J0100A — Received scheduled pain medication regimen?, if the medical record contains documentation that the resident received a scheduled pain medication to manage neuropathic pain within the five-day look-back period.

The symptoms of neuropathic pain can include shooting and burning pain, tingling, and numbness, CADPH noted. Keep in mind that residents who suffer from neuropathic pain may have an accompanying or underlying debilitating condition, and may not be able to perform their activities of daily living (ADLs) effectively.

Question 2: Our nursing home sent a resident to the ER for complications following a hip fracture. The resident died while in the ER due to an embolism. Should we complete a Death in Facility or a Discharge assessment?

Answer 2: Because the resident was admitted to the hospital and treated in the ER, you would complete a Discharge assessment, according to the Oklahoma State Department of Health (OSDH) Quality Improvement & Evaluation Service. For Item A2100 — Discharge Status, you would code 03 — Acute hospital.

Refer to your documentation and the resident’s status at the time of discharge to determine whether to code Item A0310F as 10 — Discharge assessment-return not anticipated or 11 — Discharge assessment-return anticipated, OSDH instructed.

Question 3: Can our facility face penalties for doing extra quarterly MDS assessments?

Answer 3: “There is no penalty for doing an early quarterly assessment,” CADPH said. At a minimum, you must complete three quarterly assessments in each 12-month period.

You can stagger Omnibus Budget Reconciliation Act (OBRA) assessments to accommodate your facility’s MDS due dates, CADPH noted. But with quarterly assessments, the Assessment Reference Date (ARD) must be within 92 days after the ARD of the previous OBRA assessment — Quarterly, Admission, Significant Change in Status Assessment (SCSA), Significant Correction of Prior Assessment (SCPA), or Annual Assessment plus 92 days.

Question 4: Can I count therapy minutes on a “skip day” (when the resident is not in the building at midnight) or the day of discharge?

Answer 4: Yes, you can, answered Carol Siem, MSN, RN, GNP-BC, RAC-CT in a recent Q&A for the Quality Improvement Program for Missouri (QIPMO). But you won’t find this answer in the RAI Manual. Instead, it’s in the Medicare billing manual, starting on page 47:

“Payment is not made under PPS unless a covered day can be billed. Also, for a non-covered day such as the day of discharge (for which no payment is possible under PPS), separate billing is not allowed for ancillary services. Ancillary charges for such days have already been included in the PPS rates for those days that can be billed … [A]ncillary charges for services furnished on the day of (but before the actual moment of) discharge are included in the SNF’s cost report and reflected in the final cost settlement…”

What this means: Even though the day of discharge itself is not a Medicare-covered day for your SNF, the PPS per diem for all the covered days leading up to the discharge day “is somewhat higher than it otherwise would have been, reflecting the historical cost of these day-of-discharge services,” Siem explained.

Question 5: I have residents on my Missing Resident Assessment Report who I don’t even know. Do I just ignore the report?

Answer 5: No, you must check the Missing Resident Assessment Report every month and correct any errors found, Siem stressed. Keep in mind that the report shows the last MDS received, and the Centers for Medicare & Medicaid Services (CMS) is looking for what came after this. “It could be as simple as batching the missing MDS and sending it,” she noted.

To clean up your Missing Resident Assessment Report, Siem recommended that you take the following steps:

Write on the validation report that due to CMS only accepting MDS’s that are less than three years old, CMS cannot remove these residents from the report. Systematically review the missing assessments from the oldest to the earliest, and then complete the discharge to the best of your ability and submit it.