Tara0513

Networker

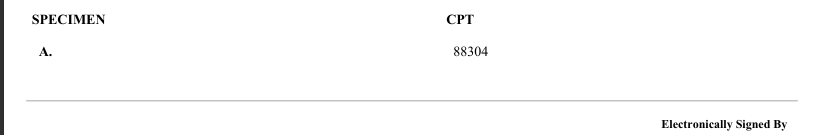

Hello All! The lab I do billing for just brought on a new client and a lot of their specimens that they are sending in are not really specimens, but a container labeled with the patient's name and a folded gauze pad with no tissue identified after scraping both sides of the submitted gauze pad. The lab is still performing an H&E. I copied the report with all personal information both of the patient and lab has been blocked out. Please tell me what I should do as far as coding this report. I did ask my pathology coders Facebook group, and they all stated there is nothing to charge, and why did the lab perform an H&E, but I have the lab pushing back that they should be paid for at least their technical services. I am trying to gather enough supporting information to bring to upper management. They will push back because they believe they should be reimbursed for all work, which I agree with, but I am not sure about these cases.