Hello everyone!

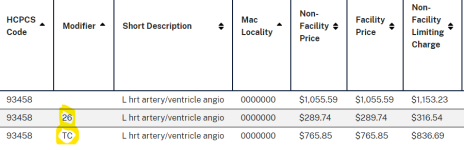

We work at a hospital where we've been receiving denials from insurance carriers that modifier -26 needs to be appended to CPT 93458 and associated codes due to cardiac catherization procedure performed in hospital setting for POS 21, 22, and 23 when performing percutaneous coronary intervention procedures.

However, the cardiac surgeon disagrees claiming that the -26 modifier should not be applied to CPT 93458 or associated codes due to major deduction in reimbursement for all of these procedures he performed.

We have reviewed many CMS guidelines for these cath procedures but more clarity is needed.

We need more clarification on guidelines for the above scenario preferably from experienced specialty coders in this field and/or coding auditors that modifier -26 should be appended to 93458 and associated procedures when performing percutaneous coronary intervention procedures in a hospital setting POS 21, 22, 23 as indicated by insurance carrier denials.

Your assistance is greatly appreciated!

We work at a hospital where we've been receiving denials from insurance carriers that modifier -26 needs to be appended to CPT 93458 and associated codes due to cardiac catherization procedure performed in hospital setting for POS 21, 22, and 23 when performing percutaneous coronary intervention procedures.

However, the cardiac surgeon disagrees claiming that the -26 modifier should not be applied to CPT 93458 or associated codes due to major deduction in reimbursement for all of these procedures he performed.

We have reviewed many CMS guidelines for these cath procedures but more clarity is needed.

We need more clarification on guidelines for the above scenario preferably from experienced specialty coders in this field and/or coding auditors that modifier -26 should be appended to 93458 and associated procedures when performing percutaneous coronary intervention procedures in a hospital setting POS 21, 22, 23 as indicated by insurance carrier denials.

Your assistance is greatly appreciated!